nevada estate tax exemption 2021

South Dakota and Wyoming. If you are donating by paying your FULL DMV taxes you must request a paper voucher from the Assessor and provide.

Tax On Insurance Do Beneficiaries Pay Taxes On Life Insurance Aegon Lifeaegon Life Blog Read All About Insurance Investing

0121 For real property file on or before December 31 of the year for which the exemption is sought.

. Property taxes are quite possibly. To donate your exemption to the Gift Account for the Veterans Home in Southern Nevada you must pay the FULL tax amount and direct the Assessors Office to distribute the taxes from your exemption to the Gift Account for the Veterans Home in Southern Nevada. Notable changes for 2021 include.

Two states levy neither a corporate income tax nor a gross receipts tax. A states corporate tax is levied in addition to the federal corporate income tax of 21 percent substantially reduced by the Tax Cuts and Jobs Act of 2017 from a graduated-rate tax with a top rate of 35 percent the highest rate among industrialized nations. The first 25000 applies to all property taxes including.

Homestead Exemption Application for Senior Citizens Disabled Persons and Surviving Spouses DTE 105A Rev. 43 - Colorado Dependent Deduction Unlike most states Colorado does not have a dependent deduction. Arkansas saw its rate drop to 62 percent on January 1 2021 as a third phase of tax reforms started in 2019 kicked in.

For manufactured or mobile homes this form must be filed on or before December 31 of the year prior to the year for which the exemption is sought. You can however claim dependent deductions on your Federal Tax Return. The homestead exemption in Florida provides a tax exemption up to 50000.

Maine Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Maine sales tax only applies to end consumers of the product. The Federal Income Tax however does allow a personal exemption to be deducted from your gross income if you are responsible for supporting yourself financially. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Maine Sales Tax Exemption Form to buy these goods tax-free.

44 - Colorado Itemized Deductions. Notable 2021 State Corporate Income Tax Changes. Companies or individuals who wish to make a qualifying purchase tax.

This rate is scheduled to. A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. Several states implemented corporate income tax rate changes over the past year among other revisions and reforms.

The Key Estate Planning Developments Of 2021 Wealth Management

Us Tax System Simplified Overview

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2020

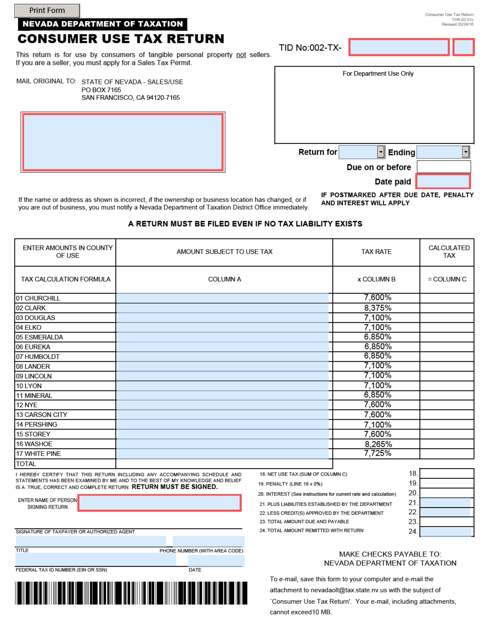

Form Txr 02 01c Download Fillable Pdf Or Fill Online Consumer Use Tax Return 2021 Nevada Templateroller

Recent Changes To Estate Tax Law What S New For 2019

Tax Exemption 2020 2021 Understand Tax Exemption And Scope Of Coverage Aegon Lifeaegon Life Blog Read All About Insurance Investing

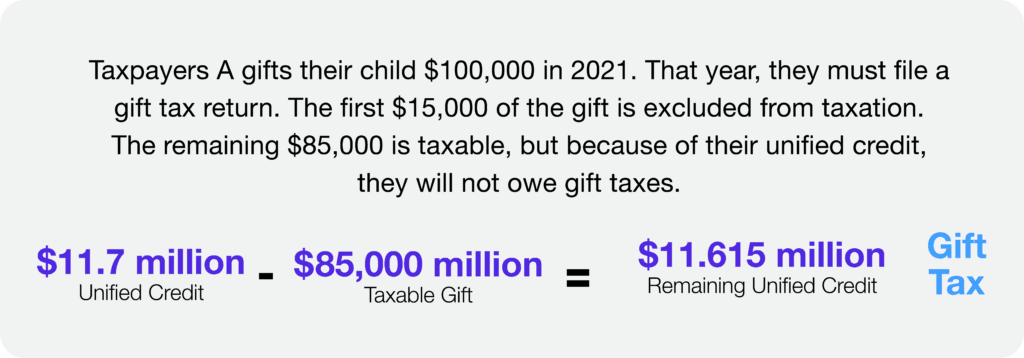

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

Effect On Family Farms Of Changing Capital Gains Taxation At Death Morning Ag Clips

2021 2022 Tax Brackets Rates For Each Income Level

Exploring The Estate Tax Part 2 Journal Of Accountancy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Vs California Taxes Explained Retirebetternow Com

Govt Announces Tax Exemption For Expenditure On Covid 19 Treatment Ex Gratia Received

State Corporate Income Tax Rates And Brackets Tax Foundation

What Estate Planning Should You Do Now That Congress Might Not Change Anything

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)